Home » Plugins & Tools » Kopesha Mpesa Loans WordPress Plugin

Kopesha Mpesa Loans WordPress Plugin

Simple Mpesa loan application WordPress plugin. Features manual eligibility checks & Mpesa STK push payments for verification fees.

$129.00 Original price was: $129.00.$59.00Current price is: $59.00.

- Pay once, not monthly

- Fast customer support

- 1-Year Protection included

- Handpicked selected deals

Overview of the Kopesha Mpesa Loans WordPress Plugin

The Kopesha Loan Application plugin is a tailored solution for Kenyan lenders needing a simple Mpesa loan application WordPress plugin. Built for the local market, this plugin provides a loan application form with Mpesa payment integration for verification fees. It’s the ideal starting point for any micro-lending WordPress website.

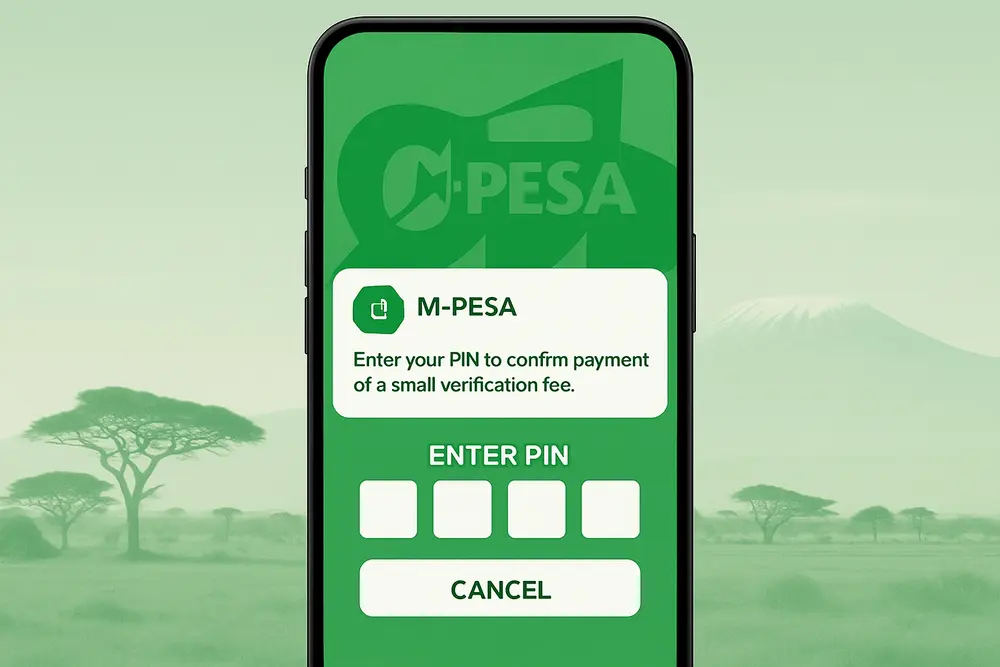

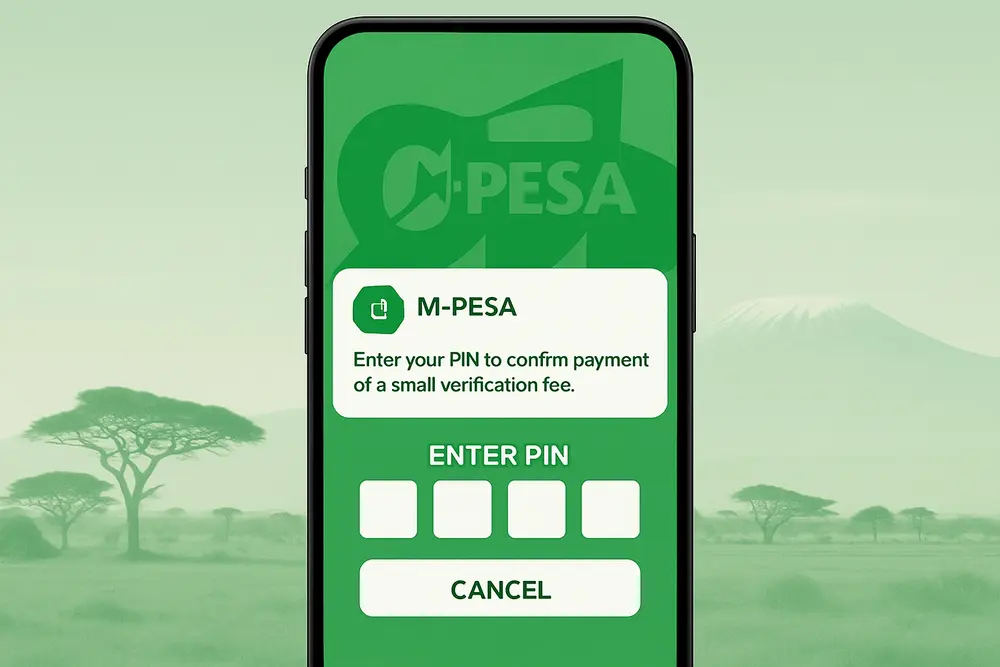

Applicants fill out a form, which is then submitted for your manual loan eligibility check. To reduce spam, the plugin requires a small fee via an Mpesa verification fee STK push. This automated step ensures only serious applicants proceed. This WordPress plugin for SACCOs in Kenya allows you to easily manage all applications from the backend, digitizing your lending process efficiently.

Key Features

- Simple Loan Application Form: A clean form, making this the most user-friendly Mpesa loan plugin.

- Mpesa STK Push Integration: Automatically triggers an Mpesa STK push to collect a verification fee.

- Manual Eligibility Checks: All applications are stored for your team’s manual loan eligibility check.

- Spam Reduction: The mandatory Mpesa verification fee STK push filters out non-serious applicants.

- Application Management Dashboard: A central place to manage your micro-lending WordPress applications.

- Designed for the Kenyan Market: The perfect WordPress plugin for SACCOs in Kenya and other lenders.

Use Cases (Who is this for?)

- Micro-lenders & Digital Lenders: A low-cost way to start accepting applications with this simple Mpesa loan application WordPress plugin.

- SACCOs: Digitize the initial application step with a loan application form with Mpesa payment.

- Chamas & Investment Groups: Manage internal lending and fee collections with this Kopesha plugin.

- Small Financial Institutions: A great tool for any organization needing a basic system for application intake.

Frequently Asked Questions (FAQs)

Yes, to use the Mpesa STK push feature, you need Daraja API credentials for your Paybill or Till.

No. This Mpesa loan plugin is designed for lenders who perform a manual loan eligibility check.

It’s a prompt on a user’s phone to enter their M-Pesa PIN, enabling the Mpesa verification fee STK push payment.

This simple Mpesa loan application WordPress plugin comes with a standard set of fields, with customization planned for future updates.

| 5 star | 100 | 100% |

| 4 star | 0% | |

| 3 star | 0% | |

| 2 star | 0% | |

| 1 star | 0% |

-

Ahmed N.Reviewer

Kopesha Mpesa Loans WordPress Plugin

Kopesha Mpesa Loans WordPress Plugin -

Wanjiku M.Reviewer

Kopesha Mpesa Loans WordPress Plugin

Kopesha Mpesa Loans WordPress Plugin -

Isela AlvarezReviewer

Kopesha Mpesa Loans WordPress Plugin

Kopesha Mpesa Loans WordPress Plugin

Sorry, no reviews match your current selections

Kopesha Mpesa Loans WordPress Plugin

Simple Mpesa loan application WordPress plugin. Features manual eligibility checks & Mpesa STK push payments for verification fees.

$129.00 Original price was: $129.00.$59.00Current price is: $59.00.

- One-time Payment - No monthly renewals

- Fast customer support

- 1-Year Protection included

- Handpicked selected deals

Product Screenshots

You May Also Like

Professional WooCommerce cart and checkout block customizer plugin with...

$59.00 Original price was: $59.00.$39.00Current price is: $39.00.

Connect your Elementor forms to WhatsApp and enable users to send contact...

$39.00 Original price was: $39.00.$29.00Current price is: $29.00.

A powerful Elementor store locator plugin for WordPress with...

$59.00 Original price was: $59.00.$49.00Current price is: $49.00.

Free

Plugin Folders Manager lets you organize plugins into folders, categorize plugins, and...

$69.00 Original price was: $69.00.$39.00Current price is: $39.00.

The ultimate WooCommerce custom dashboard plugin that transforms your default account page...

$99.00 Original price was: $99.00.$69.00Current price is: $69.00.

A lightweight plugin that automatically replaces Add to Cart button with View...

$19.00 Original price was: $19.00.$9.00Current price is: $9.00.

Track and analyze WordPress plugin performance, load time, and resource usage to...

$69.00 Original price was: $69.00.$39.00Current price is: $39.00.

Free

Elementor Form Locator helps you instantly find where every Elementor form is...

$49.00 Original price was: $49.00.$29.00Current price is: $29.00.